Taking Advantage of High-Interest Rate Savings Accounts

- Elliot Klass

- Feb 10, 2023

- 1 min read

In today's economy, saving money has become more important than ever. With the rise of cost of living and inflation, it is essential to find ways to grow your savings and protect your wealth. One way to achieve this is by opening a high-interest rate savings account.

In Australia, there are several high-interest rate savings accounts offered by different banks and financial institutions. These accounts are designed to help customers grow their savings faster, and provide them with more opportunities to reach their financial goals.

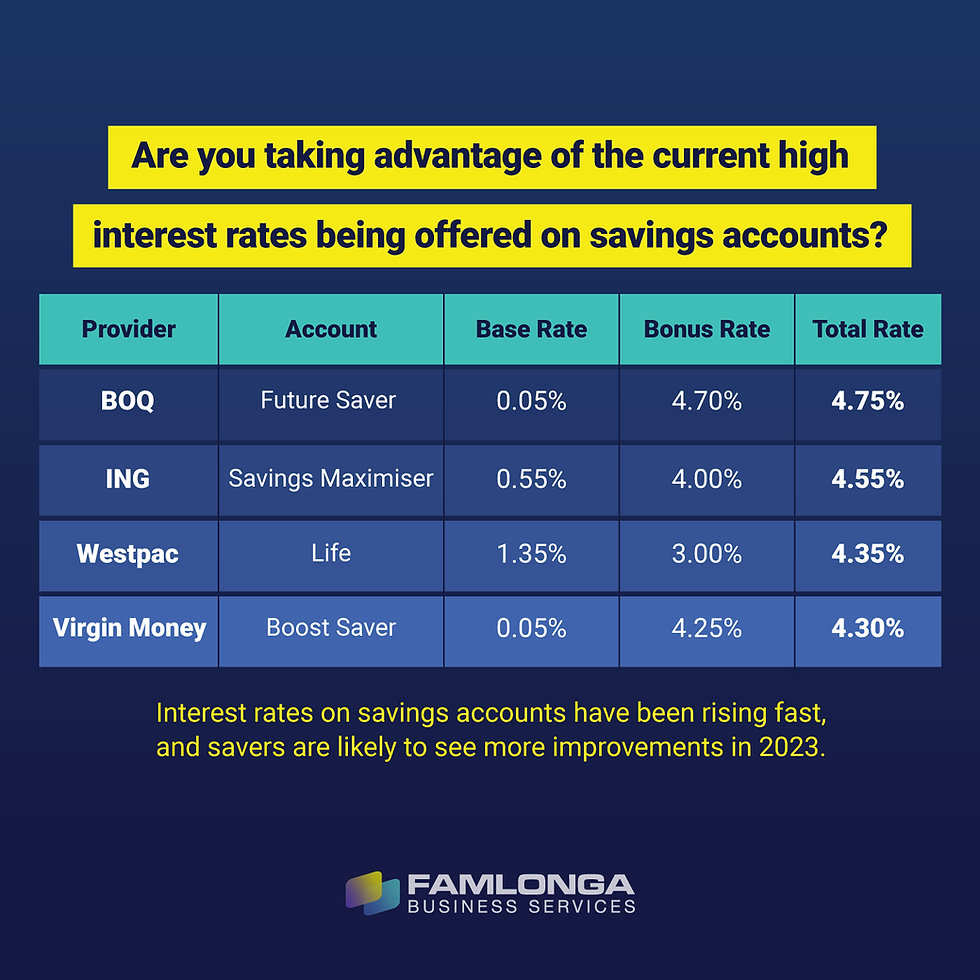

Some of the best high-interest rate savings accounts in Australia are now being offered by Bank of Queensland (4.75%), ING (4.55%), Westpac (4.35%) and Virgin Money (4.30%). Additionally, the account is available online, which makes it easy and convenient for customers to access and manage their funds.

In conclusion, high-interest rate savings accounts are a great way for you to grow your savings faster and reach your financial goals. With a range of options available from different banks and financial institutions, it is important to do your research and choose the account that best fits your individual needs. Whether you are saving for a down payment on a home, for retirement, or just to have a safety net for emergencies, a high-interest rate savings account is a great way to achieve your financial goals and protect your wealth.

.png)

Comments